Fighting Late Payments and Empowering Minority-Owned Businesses with Automated Solutions

As a small business owner and a member of the Black community, I have experienced firsthand the devastating effects of the outdated invoicing system. The late payment of invoices not only caused financial strain on my business but also affected our ability to meet our obligations to suppliers, employees, and other stakeholders. This experience was a painful reminder of the harsh reality that small businesses, especially small minority-owned businesses, face in today’s economic landscape.

The current invoicing system is simply not designed to support small businesses. The practice of paying small businesses, especially minority-owned businesses, a month or more after the work has been completed is unjust and unfair. This outdated system causes immense harm to small business owners and their day-to-day operations and needs to be changed.

The COVID-19 pandemic made the situation worse, as small businesses are recovering from financial difficulties due to the global health crisis.

According to a survey cited in an article by Business Wire, late payments by large firms are often deliberate and cause significant harm to the financial stability and growth of small businesses. The situation is dire, and the effects of the outdated invoicing system are far-reaching and devastating.

The challenges outlined in an article by Receivables Savvy, such as inadequate invoicing processes, inaccurate or incomplete invoices, and manual invoice processing, only serve to exacerbate the problems faced by small businesses. These challenges lead to longer payment times, decreased cash flow, and potential harm to customer relationships. It is imperative that we find a solution to this problem and create a more equitable system for small and minority-owned businesses.

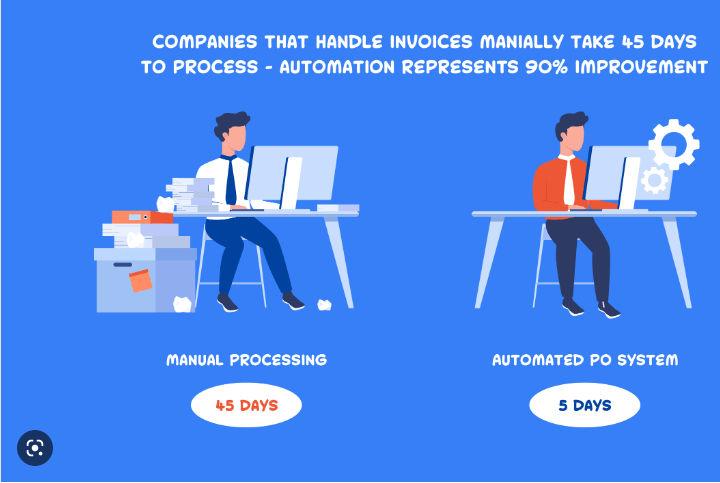

Automated invoice processing is a step in the right direction. It can improve the accuracy and efficiency of invoicing, reduce the risk of errors, and help small businesses receive payments more quickly. By adopting modern, automated invoicing solutions, small businesses can take control of their financial health and improve their cash flow.

The overdue payment of invoices presents a pressing challenge for small and minority-owned businesses. The outdated invoicing system is unjust, and unfair, and causes immense harm to small business owners. By advocating for more responsible payment practices by large companies and by implementing modern, automated invoicing solutions, we can create a fairer and more sustainable system for small businesses. The time has come for us to take action and create a brighter future for small and minority-owned businesses.