Why volatility, tariffs, and a falling dollar are making me cautious but not immobile

A Sea of Red and a Moment of Reflection

Every time I log into my brokerage account, I feel the familiar punch of anxiety. Nvidia has dropped below $100. Microsoft has slipped under $400. The screen is red, and the losses are real. I have learned to remind myself: You do not lose if you do not sell.

That phrase offers emotional protection, but it also invites reflection. If the market is falling and fear is rising, is this the kind of moment that serious investors lean into? Can this downturn be an opportunity for those of us who have historically been shut out of the financial conversation?

I am not entirely sure, but I know this much: moments like these require more than panic. They require study, discipline, and clarity. Especially for those of us navigating both economic volatility and the weight of generational exclusion from wealth-building systems.

Trump’s Tariffs and the Trillion-Dollar Fallout

President Donald Trump’s “Liberation Day” announcement on April 2, 2025, set off a global economic chain reaction. The policy includes a blanket 10 percent tariff on all imports and an additional “reciprocal” tariff formula targeting 90 countries. According to JPMorgan, these tariffs constitute the largest U.S. tax increase since 1968, sparking a two-day market rout that erased over $6 trillion in market value (Clark & Kim, Barron’s, April 2025).

On April 3 and 4, the S&P 500 plunged over 10 percent, marking its steepest two-day loss since the onset of the COVID-19 pandemic. Nvidia alone dropped more than 13 percent, even though semiconductors were initially exempt from the tariffs. Market analysts at Truist and J.P. Morgan noted that retail investors bought the dip in historic volumes. While that may reflect confidence in long-term AI infrastructure, it also raises concern about herd behavior and misplaced optimism in a volatile environment.

These moves triggered a sharp and immediate retaliation from China, which announced a 34 percent tariff on all U.S. goods, effective April 10 (CBS News, April 2025).

Flawed Formulas, False Premises

The logic behind these tariffs is as concerning as their impact. The Trump administration used a flawed formula to justify reciprocal tariffs, relying on distorted estimates of foreign trade barriers. According to economists at the American Enterprise Institute, no country’s tariff should exceed 14 percent if elasticity had correctly been calculated. Lesotho, for example, was assigned a 50 percent tariff due to these errors (Doherty, CNBC, April 2025).

This isn’t just a math problem. It is a policy problem with global implications. The Cato Institute and Yale Budget Lab found that the administration’s estimates dramatically overstate foreign tariff rates. As a result, the U.S. is hitting countries with economically unjustified penalties—inviting retaliation and destabilizing supply chains.

Economist Ernie Tedeschi, formerly of the U.S. Treasury, estimates these tariffs could reduce household purchasing power by $3,800 annually and shave nearly a whole percentage point off fourth-quarter GDP growth.

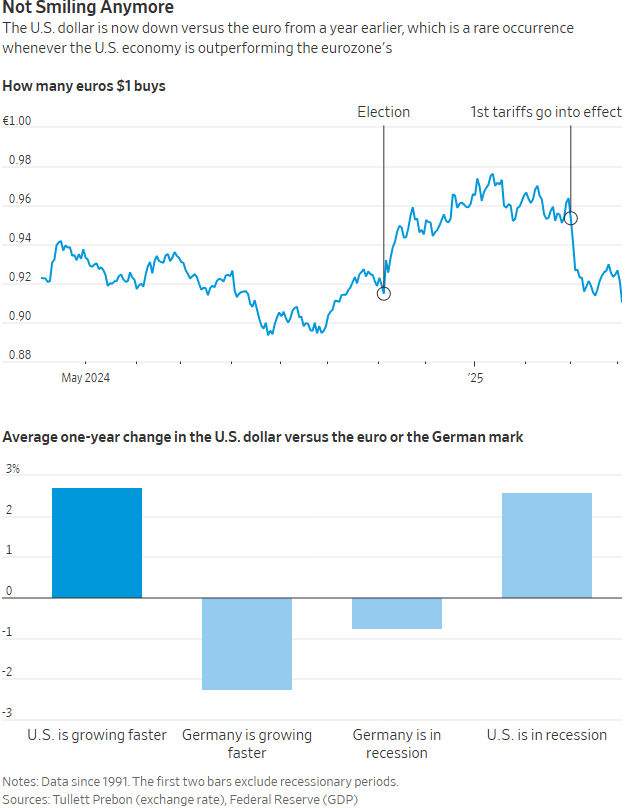

A Falling Dollar and Fading Faith

Equally troubling is the fall of the U.S. dollar. Conventional wisdom holds that tariffs would boost the dollar by curbing imports. Instead, the WSJ Dollar Index has dropped nearly 6 percent this year, falling below pre-election levels.

This may reflect something deeper than market mechanics. According to Jon Sindreu of The Wall Street Journal, we are witnessing a currency correction and a collapse in investor confidence in the long-term viability of U.S. economic leadership. If the dollar’s strength in recent decades reflected a belief in American innovation, particularly in tech and services, then its decline signals something far more dangerous: eroding faith in the U.S. as a stable global leader (Sindreu, WSJ, April 2025).

This moment echoes lessons from Dani Rodrik’s The Globalization Paradox (2011), where he argued that economic nationalism, if not paired with industrial strategy and institutional coherence, often leads to instability rather than sovereignty. History also reminds us that protectionism without production capacity can stagnate domestic growth. Latin America’s mid-20th century import-substitution policies failed precisely because they disconnected local economies from global competition.

Why I’m Still Watching, Still Learning

Despite all of this, I find myself still thinking about investing.

That may seem irrational, even naive. Yet it feels urgent. Not because I believe the market will bounce back tomorrow but because I understand that wealth is often built during downturns when others retreat. The catch is knowing how to engage, not with hype or fear, but with discipline.

We complain, rightfully, about our lack of access to wealth-building tools. We talk about redlining, underfunded schools, and the barriers to generational wealth. Those structural realities remain true. However, this moment offers another lesson: without collective financial literacy, even access won’t save us.

This is why I’m reading, listening, and talking to people who know more than I do. I am not chasing every dip. I am learning what sectors are most vulnerable and which might emerge stronger. I am studying companies that manufacture capital goods, global ETFs, and currency devaluation risks.

This Is About More Than Stocks

This is about reclaiming space in a conversation that too often ignores us.

This is not simply about financial returns for Black communities and working-class investors. It is about economic agency. This moment requires more than buying stock. It demands that we understand how policy, global trade, and corporate behavior intersect with our daily lives.

As Dr. Julianne Malveaux reminds us in Unfinished Business (2011), “economic justice is not a sideshow to civil rights; it is its very heart.”

I am still thinking about investing, not because I feel confident, but because I believe we can no longer afford to remain passive. The system is unstable, yes. However, with knowledge, community, and care, we can respond with clarity and build something lasting.